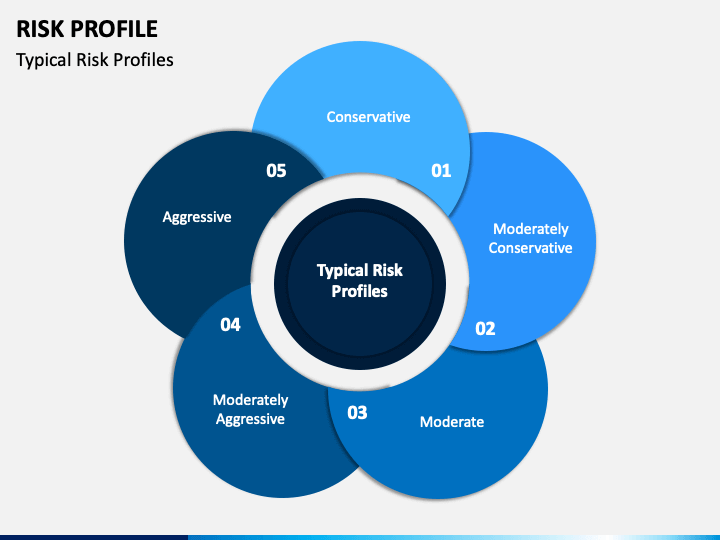

Risk Profiling

Importance of Risk Profiling

Why Choose Investments Based on Risk Profile

Choosing investments without understanding risk tolerance can lead to issues. For instance, if someone who prefers low-risk investments is given high-risk mutual funds, they might feel uncomfortable and could even sell at a loss if markets drop.

Similarly, if a high-risk investor is given low-risk options, they may not achieve the growth they expect. By matching investments to risk profiles, it’s possible to create a balanced plan that is suitable and comfortable for the client.

We follow a structured risk profiling process. We talk with our clients to understand their goals, financial background, and risk preferences. We may ask simple questions about their experience with investments, how they react to market fluctuations, and their financial goals.

Once we understand their risk profile, we suggest funds that are best suited to their preferences, ensuring they feel confident and satisfied with their investment choices. This process builds trust and helps us create a lasting relationship with our clients.