A beginner’s guide to investing smart, starting small, and building long-term wealth

Let’s dive into “How to Start Investing in India: What to Do, When to Begin & Where to Put Your First ₹500 “

You’ve already done the hardest part — deciding to take control of your money.

Whether you’re just starting out or tired of idle savings, this guide is your launchpad.

Let’s clear the fog around investing.

Just a friendly hand guiding you through the ‘how’, ‘when’, and ‘where’. Ready?

When Should You Start Investing?

Now. Not next month. Not “after the bonus.”

The best time to start investing was yesterday. The next best time is today.

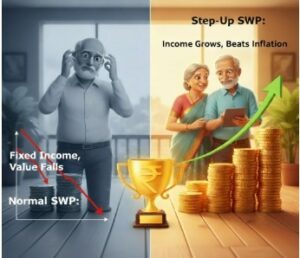

The earlier you begin, the more you benefit from compounding — where your money earns money on the money it already earned.

Where to Start Investing?

Mutual Funds (especially Index Funds or ELSS): Great for beginners.

Recurring SIPs: Start small with ₹500–₹1000 a month.

Trusted Platforms: Groww, Zerodha, Paytm Money — easy to use, trusted, beginner-friendly.

You don’t need a demat account to start mutual fund SIPs — just your PAN, Aadhaar, and a few minutes.

How to Start Investing?

You have two paths — both valid, both practical:

🛠 Do-It-Yourself (DIY)

Research mutual funds online (sites like Value Research, Morningstar India)

Use direct investment apps (like Coin by Zerodha, Fundzbazar, Groww)

Set up SIPs manually

This works well if you enjoy learning, comparing, and keeping track.

🧭 Go With a Financial Advisor

If you’re confused, anxious, or unsure what suits your life stage — talk to an advisor.

Not all heroes wear capes; some wear formals and help you build wealth.

Still Unsure? DM us, talk to a SEBI-registered advisor, or follow a simple DIY plan.

Whether you’re doing it yourself or with guidance — take that first step today.

Your First ₹500 Can Build Your Future ❤️

Let’s grow — one SIP at a time. Together